U.S. Treasury Yields Surge Amid Growing Fiscal Risks, Challenging Market Optimism

TOPICSU.S. Treasury yields surged to their highest levels on Thursday, driven by rising concerns over the ballooning U.S. debt and weak demand at recent bond auctions. The 30-year Treasury yield climbed above 5.10%, while the 10-year yield reached 4.6%, reflecting investors’ demand for higher returns amid growing fiscal risks.

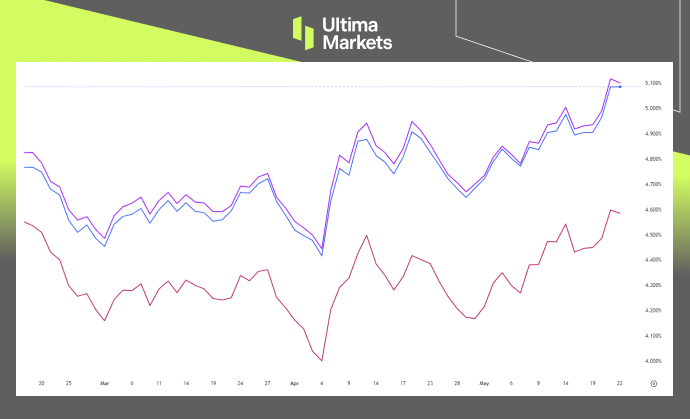

U.S. 10, 20, 30-year Treasury Yield Curve | Chart Source: TradingView

U.S. Treasury Yields (As of May 22,2025):

- 10-year Yield: 4.6%;

- 20-year Yield: 5.109%;

- 30-Year Yield: 5.10%;

These rising yields were further compounded by weak demand at the Treasury Department’s 20-year bond auction earlier this week, which required a 5.047% yield to attract buyers—signaling hesitancy and low confidence amid mounting credit risk following Moody’s downgrade of the U.S. credit rating from AAA to AA1.

Mounting Fiscal Challenge in U.S.

In 2025, approximately $9.2 trillion in U.S. Treasuries—roughly one-third of all outstanding marketable debt—is set to mature, with an estimated 55–60% coming due before July 2025.

According to FiscalData.Treasury.gov, the total gross national debt of the United States stood at approximately $36.21 trillion as of May 2025. Interest payments alone are projected to reach around $684 billion in fiscal year 2025, accounting for 16% of total federal spending.

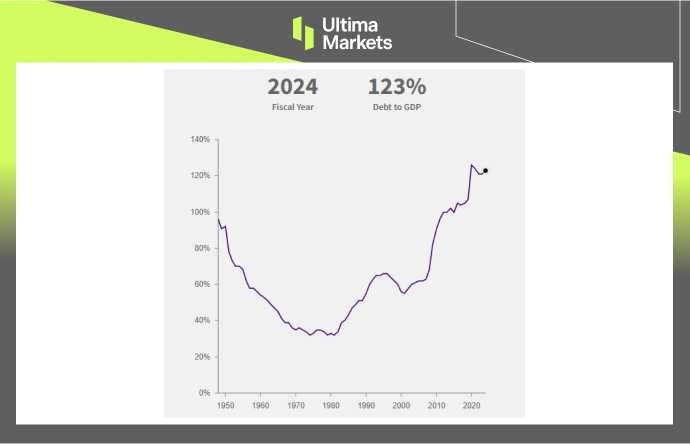

US Debt to GDP Ratio for 2024 | Source: FiscalData US government

The U.S. debt-to-GDP ratio is projected to rise to 124.4% by the end of 2025. This continuing upward trend highlights how federal borrowing is increasingly outpacing economic growth.

While a high debt ratio has historically been sustainable for the U.S. economy, concerns are growing as Treasury yields remain elevated following the Federal Reserve’s rate hike cycle. The fiscal burden is further intensified by policy uncertainty, particularly surrounding the rollout of new tariff measures, which could weigh on growth and government revenues.

Market Implication: Rising Risks

The recent bond market volatility and surge in Treasury yields reflect growing concerns as the U.S. government must refinance a large portion of its debt at higher interest rates. If bond auctions continue to show weak demand, yields may remain elevated—or rise further—putting pressure on the U.S. Dollar and equity markets.

Concerns about fiscal sustainability and political gridlock are also weighing on long-term confidence in the Dollar, especially as credit quality risks increase.

For U.S. equities, higher yields tighten financial conditions by raising borrowing costs. This can dampen corporate earnings, reduce consumer spending, and weaken market sentiment.

Markets now face a challenging environment: fiscal stress, tighter credit conditions, and increased policy uncertainty. Together, these factors may reduce risk appetite, increase volatility, and prompt investors to demand higher risk premiums—not just for Treasuries, but across global asset classes.

US Indices Outlook: Rally Faces Headwinds

The S&P 500 has rallied strongly on renewed optimism over initial U.S.-China trade discussions, pushing the index back into bullish territory and nearing its all-time highs.

However, risks remain. Uncertainty over future trade negotiations and resurfacing U.S. fiscal concerns raise questions about the sustainability of this upward momentum. As the index approaches record levels, these macroeconomic headwinds could cap further gains in U.S. equities.

SP500, Day Chart Analysis | Source: Ultima Market MT5

From a technical perspective, the 6000-point mark remains a key psychological level for the S&P 500. Despite a strong recovery above the 5700 zone, the recent pullback suggests waning momentum.

While no significant breakdown has occurred yet, 5700 is emerging as a crucial support level. A break below this could signal renewed downside pressure and another round of challenges for the broader U.S. equities market.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server